Latest Version

Version

2.3.198

2.3.198

Update

February 06, 2024

February 06, 2024

Developer

Step Mobile, Inc

Step Mobile, Inc

Categories

Finance

Finance

Platforms

Android

Android

Downloads

134

134

License

Free

Free

Package Name

com.step.step

com.step.step

Report

Report a Problem

Report a Problem

More About Step: Build Credit Get Rewards

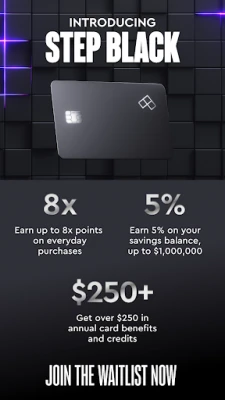

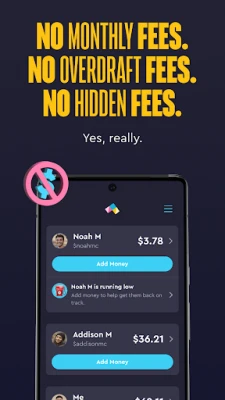

Step, the all-in-one banking app and Visa Card, is the best way to build credit without debt. Enjoy top-notch benefits like up to 8% cash back on purchases, 5.00% on your FDIC-insured savings balances, getting paid early with direct deposit, and a commission-free stock investment platform. The best part? You don’t have to pay a single monthly or subscription fee. Join over 4.5+ million people who trust Step to help them build credit and start improving your financial future.

Benefits of Step:

- Build credit: Safely build credit with every purchase and monitor your credit score right from the Step app

- Earn up to 8% cash back: Shop everywhere Visa Cards are accepted – online, in-store, worldwide – and earn up to 8% cash back on purchases

- Earn 5.00% on your savings: Plus set Savings Goals and automatically add to them with Round Ups.

- Invest with as little as $1: Buy and sell thousands of stocks, ETFs, and bitcoin for as little as $1. Turn your spare change into smart investments with Round Ups.

- Get Paid Early: Get paid up to 2 days early, instantly send and receive money, deposit cash at 70,000+ retail locations nationwide, and access over 30,000 fee-free ATMs

¹Step is a financial services platform. Banking services provided by and the Step Visa card issued by Evolve Bank and Trust, member FDIC.

²Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use.

³Out-of-network ATM withdrawal fees apply.

⁴Early access to direct deposit funds depends on the timing of the submission of the payment file from your payer. These funds are generally made available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

- Build credit: Safely build credit with every purchase and monitor your credit score right from the Step app

- Earn up to 8% cash back: Shop everywhere Visa Cards are accepted – online, in-store, worldwide – and earn up to 8% cash back on purchases

- Earn 5.00% on your savings: Plus set Savings Goals and automatically add to them with Round Ups.

- Invest with as little as $1: Buy and sell thousands of stocks, ETFs, and bitcoin for as little as $1. Turn your spare change into smart investments with Round Ups.

- Get Paid Early: Get paid up to 2 days early, instantly send and receive money, deposit cash at 70,000+ retail locations nationwide, and access over 30,000 fee-free ATMs

¹Step is a financial services platform. Banking services provided by and the Step Visa card issued by Evolve Bank and Trust, member FDIC.

²Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use.

³Out-of-network ATM withdrawal fees apply.

⁴Early access to direct deposit funds depends on the timing of the submission of the payment file from your payer. These funds are generally made available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Stars Messenger Kids Safe ChatConnect Works

Love Island: The GameFusebox Games

WhatsApp MessengerWhatsApp LLC

VPN Vault - Super Proxy VPNAppsverse, Inc.

Gaijin PassGaijin Distribution KFT

Tik VPNTik VPN Studio

ContactsGoogle LLC

Telegram XTelegram FZ-LLC

My Disney ExperienceDisney

GmailGoogle LLC

More »

Editor's Choice

My Disney ExperienceDisney

Telegram XTelegram FZ-LLC

Microsoft Edge CanaryMicrosoft Corporation

Tik VPNTik VPN Studio

HideMe - Smart Safe InternetIronMeta Studio

WhatsApp MessengerWhatsApp LLC

WhatsApp MessengerWhatsApp LLC

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited